How to Report Your Coinbase Taxes

Coinbase tax filing can seem complex, but with the right steps and tools like Blockstats, reporting your crypto tax is seamless.

Quick summary:

|

Exchange/Platform |

Coinbase |

|

Supported Method |

Direct Connect |

|

Estimated time |

2-5 min |

|

Get Started |

This comprehensive guide details exactly how to do your Coinbase taxes, from downloading the necessary documents to seamlessly integrating your data with Blockstats for accurate reporting of capital gains and income.

How to connect Coinbase and Blockstats: Step-by-Step guide

Using the API connection is the most efficient and error-free method for getting your full, real-time transaction history from Coinbase into Blockstats. This method auto-syncs all past and future transactions.

Follow the step-by-step guide:

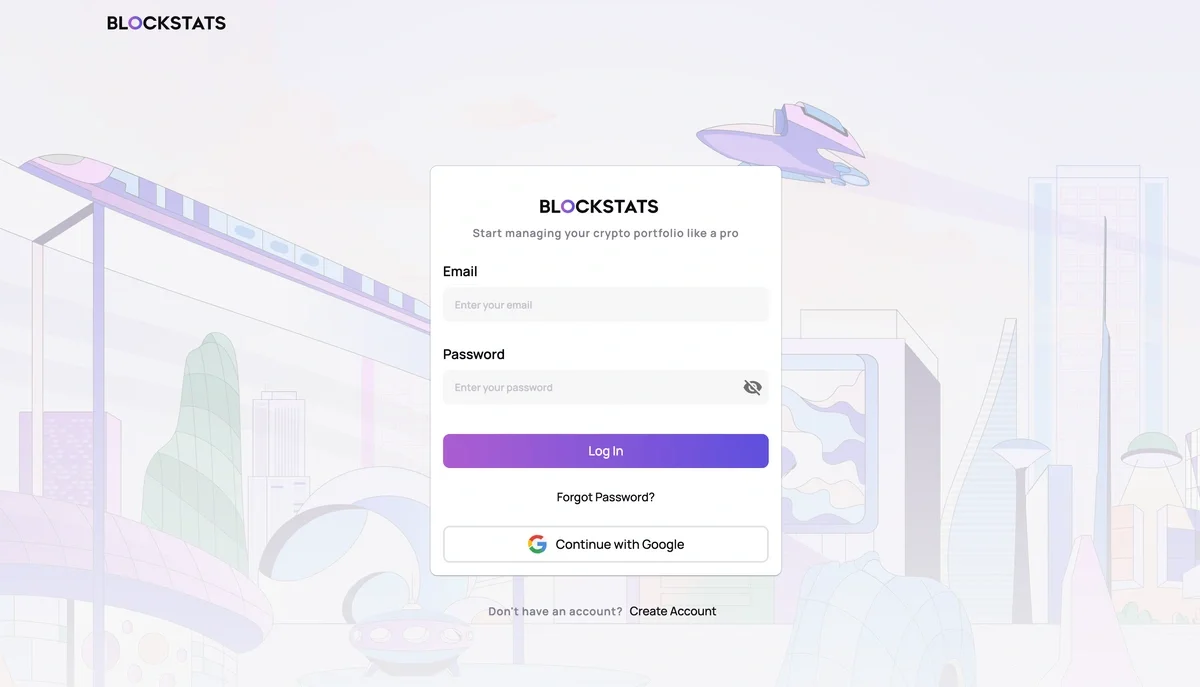

Step 1: Log in or sign up for your Blockstats account

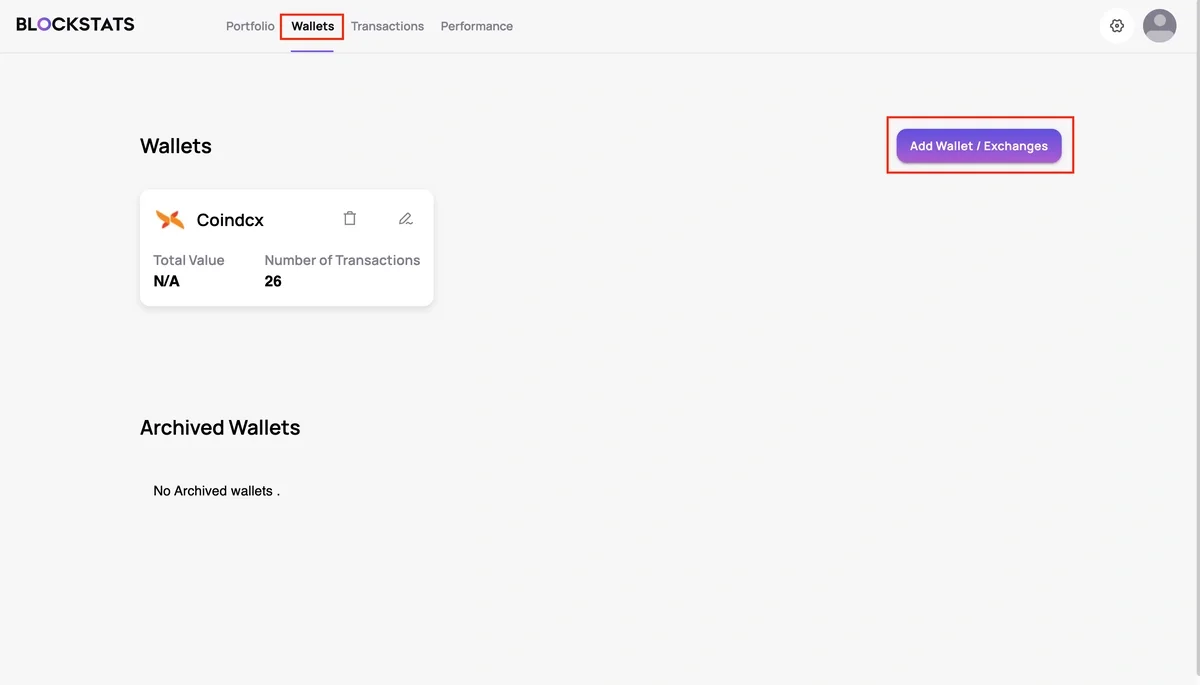

Step 2: Go to the Wallets Page and then Add Wallet / Exchanges

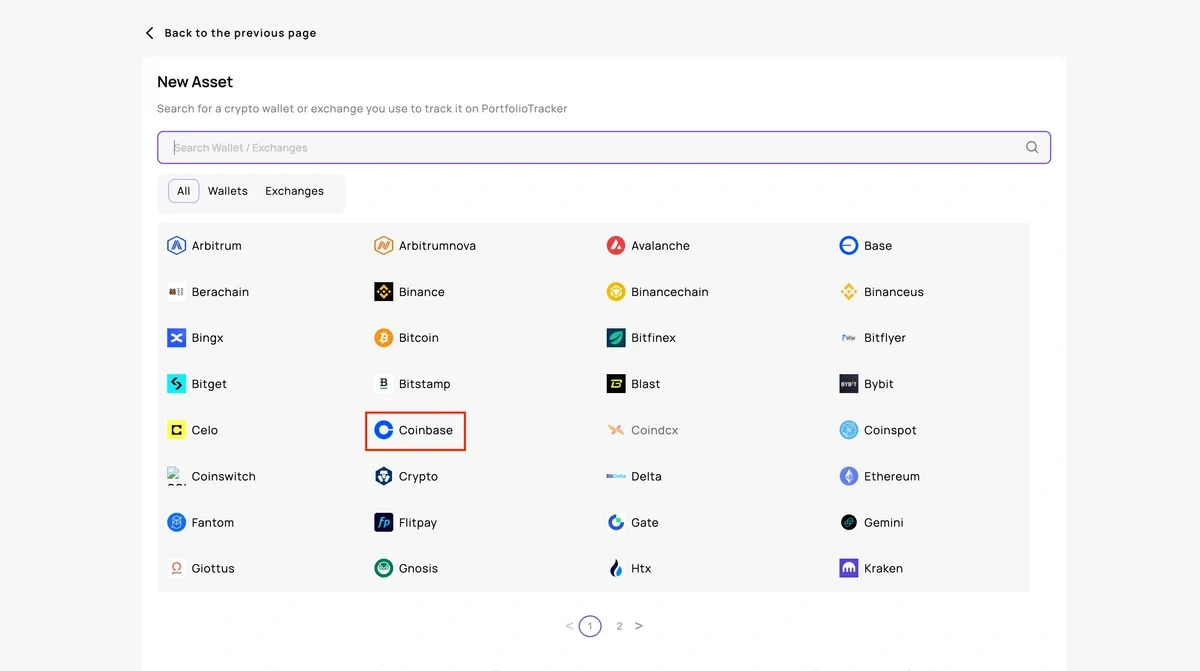

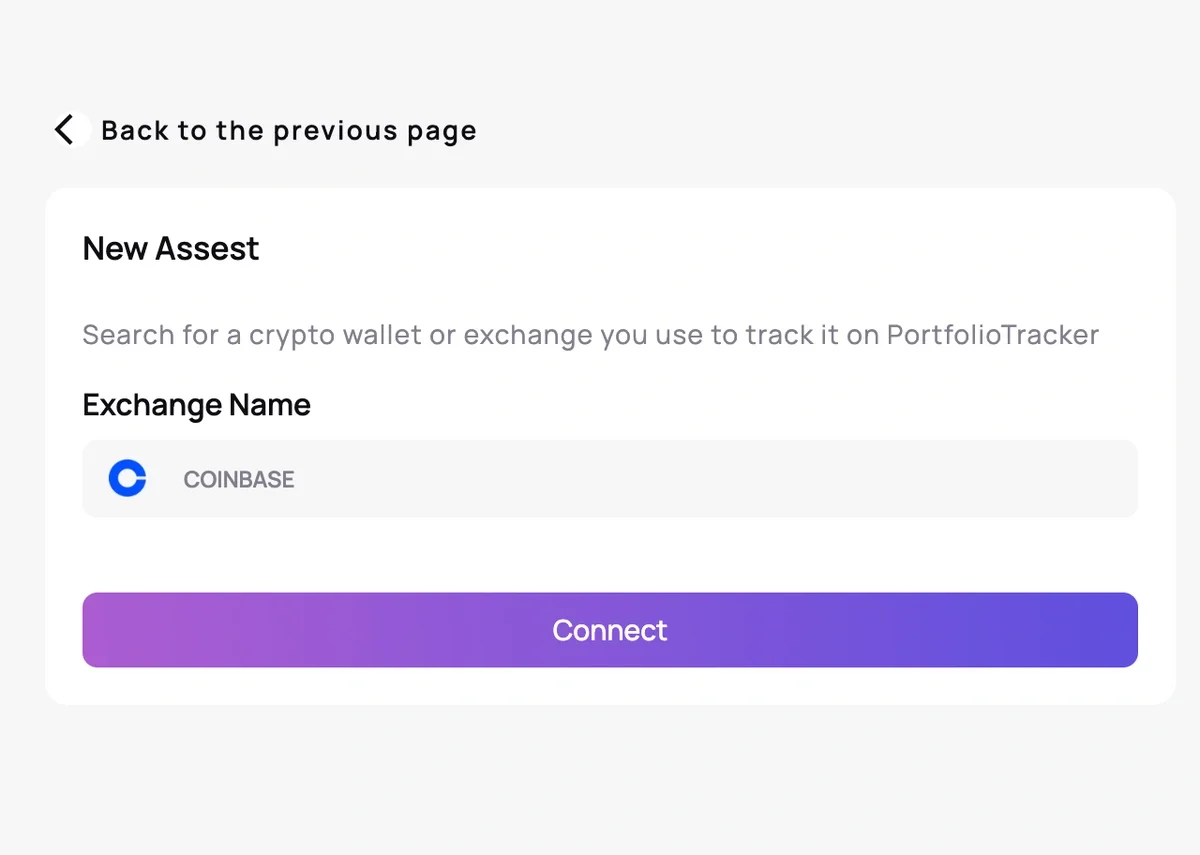

Step 3: Search for and select the Coinbase exchange

Step 4: Click on the Connect button

Step 5: You will be redirected to the Coinbase website. Log in to Coinbase and authorize. Click on Allow access to grant permission if prompted.

Review and analyze your transactions

Once the integration is complete, you can:

-

Analyze your transactions.

-

Generate tax reports.

-

Manage and optimize your cryptocurrency portfolio with Blockstats.

By following these steps, you can leverage the powerful tools offered by Blockstats to streamline your crypto portfolio management while maintaining secure access to your data.

How are Coinbase transactions taxed?

Your Coinbase tax implications are determined by your country of residence. Refer to our USA crypto tax guide. In the U.S., most crypto transactions fall into two main categories for taxation: Capital Gains Tax and Income Tax.

Capital Gains Tax

This applies when you sell, trade (crypto-to-crypto swap), or spend cryptocurrency.

-

Taxable Event: A disposal event where the Fair Market Value (FMV) at the time of the sale/trade is different from your cost basis, that is the price you paid for the asset.

-

Short-Term Gain/Loss: Crypto held for one year or less is taxed at your ordinary income tax rate.

-

Long-Term Gain/Loss: Crypto held for more than one year is taxed at the more favorable long-term capital gains rates which is 0%, 15%, or 20%, depending on your income.

Income Tax

This applies when you receive crypto as a reward, staking income, mining reward, or airdrop.

-

Taxable Event: The crypto is taxed as income based on its Fair Market Value in Fiat like USD at the moment of receipt. This income is added to your total taxable income.

Does Coinbase report to the IRS?

Yes, Coinbase reports certain user activity to the IRS. Global tax agencies, including the IRS, are increasing efforts against crypto tax non-compliance. They are cooperating with exchanges to access KYC data and verify reported crypto income.

Additionally, the IRS has used a John Doe Summons, forcing the exchanges to hand over customer data.

How to do your Coinbase taxes?

Every disposal of cryptocurrency is a taxable event. The key to filing accurately is gathering a complete record of your transaction history and calculating the correct cost basis for every asset sold, traded, or spent.

Due to the volume and complexity of crypto transactions, most users find that Blockstats crypto tax software is the most reliable way to calculate their final tax liability.

Ready to simplify your tax calculation? Start calculating your Coinbase taxes for free with Blockstats today!

Need help?

Having trouble connecting your Coinbase account to Blockstats?

-

Visit our Help Centre

-

Reach out to us on Telegram or X (Twitter)

-

Email us at support@blockstats.app

Frequently asked questions

Why aren't my Coinbase tax documents accurate?

Coinbase's documents may be inaccurate if you transferred crypto into Coinbase from an outside wallet, Coinbase won't know the original cost basis. You transferred assets out of Coinbase. For full accuracy, you can use a crypto tax calculator that combines data from all your wallets and exchanges. This is why Blockstats is recommended by crypto investors and traders.

Do I have to pay taxes on Coinbase?

Yes, you have tax obligations if you sold crypto for a gain, traded one crypto for another, spent crypto, or received crypto income like rewards, staking, etc. Simply buying and holding crypto is not a taxable event. If you avoid it, you may face fines or even jail time.

Does Coinbase automatically deduct taxes?

No, Coinbase does not automatically deduct taxes for its users. The U.S. tax system requires you to track your gains and income, calculate your tax liability, and report it on your annual tax return.

How to report Coinbase rewards on taxes?

Coinbase rewards like staking or 'Learn and Earn' are taxed as additional income, and you need to pay income tax. It will be based on the fair market value in fiat currency at the time you received the rewards on your Coinbase account.

Does Coinbase provide tax documents?

Yes, Coinbase does provide tax documents for U.S. investors. For others, Coinbase provides a transaction history that users can export to identify their taxable gains or income.

What tax forms does Coinbase send to users?

Coinbase issues Form 1099-B and Form 1099-MISC to users. Also, all crypto exchanges operating in the U.S., including Coinbase, will begin issuing Form 1099-DA in 2026.

Do you get a 1099 from Coinbase?

You will receive Form 1099-MISC if you are a U.S. person for tax purposes and earned $600 or more in rewards/income from Coinbase during the tax year.